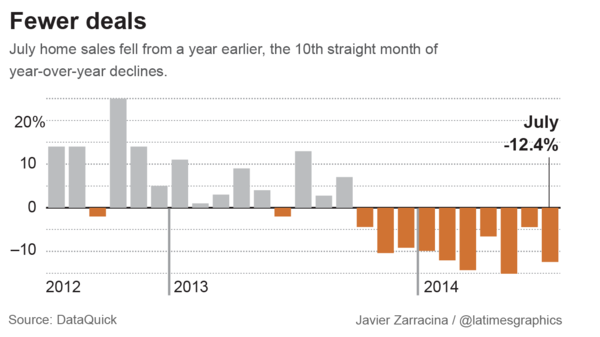

Home Sales in California were down 12% since last July

and follows steady declines since last Oct. The hope was that the spring and summer would see a pickup in demand as more homes came on the market.

This can cause a ripple effect on the Ca. economy in general as people are not doing related things like buying furniture and other things that making a new home purchase entails.

As the economy struggles, so does job growth and income. That in turn further causes problems with home affordability. So it’s a vicious cycle.

I still think that it’s all a part of a slow recovery from the worst downturn since the great depression and will take more time to right itself. We are on the right track. It will just take time. Making comparisons to a time when hedge funds were buying everything in sight is not smart.

What to do as an investor? Well rentals are still good so if you can get a good cash flow from renting or doing a lease option, that works. Taking over a property subject to with a low interest rate also works. Flipping is harder because you are depending on a pool of home owners that has shrunk. Still, inventory is low so if you can provide a lovely product at a good price, you should be ok. It’s imperative that you don’t overpay!!!!!

Want to learn what to pay so you don’t get hung out to dry? Sign up for my BASIC TRAINING BOOT CAMP on Sept 13th.