The nation’s central bank controls short-term rates and has held them near zero since the end of 2008 to support the financial system and economy.

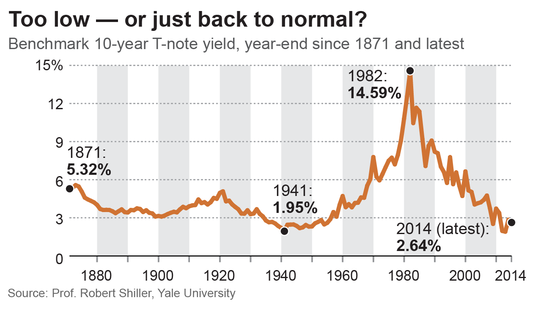

Mortgage rates are a function to the 10 year Treasury bond rate.It has been low for past few years. Is this an aberration or just a return to normal.

This is an interesting chart that shows the Federal Reserve’s rate from as far back as 1880.

Fed policymakers issued a recent report after their June meeting, making it clear that they expected to finally begin lifting their benchmark rate in 2015, if the economy continues to expand and unemployment continues to decline.

Even so, 12 of the 16 members of the policy committee expected the Fed’s rate to be no higher than 1.5% by the end of 2015 — a full 18 months from now. Asked for their rate prediction for the end of 2016, the majority of the Fed panel expected 2.5% or less.

The Fed’s key rate was more than double that, at 5.25%, in September 2007, one year before the financial system meltdown.

In addition, the European Central Bank and the Bank of Japan have been keeping interest rates depressed. Their benchmark short-term rates are even closer to zero than the Fed’s rate.

Why are central banks so cautious? Lawrence Summers, president emeritus of Harvard University and President Obama’s economic advisor in 2009-10, has warned of “secular stagnation,” the risk of the U.S. falling into a Japan-style funk marked by weak consumer spending, anemic economic growth, minimal inflation and low interest rates.

But central banks directly control only short-term rates. Long-term rates, such as on bonds, are influenced by the banks but are set by investor demand — from giant pension funds to small savers hunting for steady income.

The uncertainty in all this is inflation. If it starts to pick up, interest rates will rise. Even though energy costs have risen, wages have not risen much Growth in average hourly earnings of U.S. workers has gone from an annual rate of 3% to 3.5% before the Great Recession to around 2% since 2009, Bureau of Labor Statistics data show. That’s because of continuing high U.S. unemployment and the glut of labor overseas. Many workers have no ability to press for significant wage increases.

So it’s a dilemma, Are we heading for massive inflation with interest rate jumps or is this the new normal.? What do you think?